Is Difficulty Creating Centralization of Bitcoin?

As a P2P currency, Bitcoin is designed to be controlled by the people. The blockchain ensures the integrity of the system and enables anyone to participate in the open ledger.

One of the key features of the Blockchain, is difficulty. The algorithm is designed to become more difficult as the network grows. This is to control the rate at which Bitcoins are discovered by miners. As we all know, there will only ever be 21 Million Bitcoins mined, and we have already found over 13.5 million of them. It is expected that the last Bitcoin will be discovered in 2040.

It took us approximately 6 years to mine 64% of all the Bitcoin that will ever exist (13.5 Million). Mining the final 35%, (7.5 million) is expected to take 25 years. The supply rate will be controlled by a combination of increasing the difficulty and decreasing the reward rate.

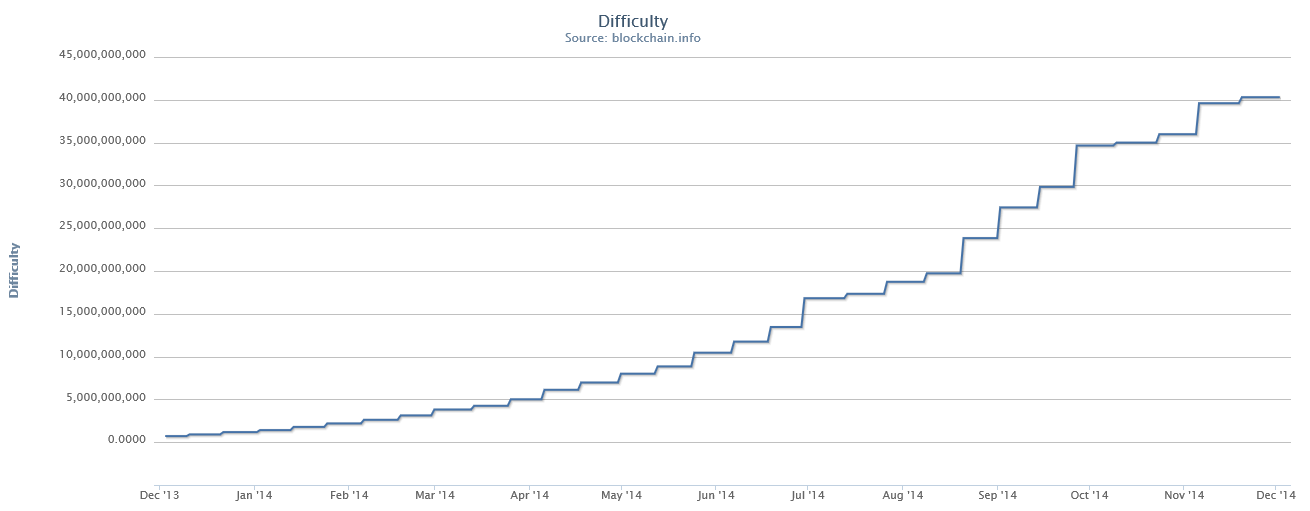

This is not good news for those hoping to make a profit from mining bitcoin. The future of mining will see difficulty increase with rewards decreasing. Difficulty has risen exponentially over the last year as shown below:

The difficulty rate for mining bitcoin has increased from 707408283.051496 to 40300030327.8914. That's a 5597% increase! Discovering a block has become 56 times more difficult in the last 12 months, and it's only going to get more difficult in the future.

As the chart below shows, this is not good for revenue, which has fallen steeply over this period, and will only fall again when the reward rate halves to 12.5 Bitcoin (expected in late 2016).

Over the same 12 months, miners revenue, in USD, has decreased from an average of approximately $4.5 Million per day to the current average of $1.5 Million per day. Mining revenue has fallen 66% in the past year

Bitcoin mining is designed to have diminishing returns. Unfortunately this means that only big players who achieve economies of scale, can turn a profit mining bitcoin. Mining bitcoin is no longer feasible to individuals, as there is no profit to be made. The only way is to pool your resources and join a major pool.

This has resulted in emergence of major players in the mining market, as shown below:

As mining becomes more difficult, major players are emerging. Currently the top 5 bitcoin miners represent 55.74% of the entire hashrate. A further 22.47% of mining capacity is controlled by 'unknown miners'. Bitcoin mining is becoming centralized to these key players.

Bitcoin is supposed to be a currency for the people regulated by the people. It's supposed to move the trust away from central figures like governments. Bitcoin has moved away from the people and is now an oligopoly controlled by a small number of corporate players.

Anyone can join a mining pool, all they have to do is purchase a share of their mining capacity. However when you join a pool, any bitcoin mined is owned by the administrator of that mining pool. It is up to them how they distribute any rewards. Joining a pool requires you to take a leap of faith and trust that the people running the pool will in fact pay you your fair share of any rewards earned.

There are several potential threats with an oligopoly including

- Collusion - The big 5 represent 55.74% of the total market, if they joined forces, they could effectively take control of the entire blockchain

- Corruption - If you don't trust a government, why are you trusting a corporation? We wrote about the case of disappearing bitcoin, who is to say that the same won't happen with one of these companies?

- Reward Distribution - The best way for individuals to become miners, is to buy

- Targets of Crime - The blockchain is secure, but how secure are each of these companies. Are you confident that a criminal couldn't hack their way inside and steal your bitcoin?

It is our opinion that the difficulty rate has grown too fast. To be a bitcoin miner, you need to either purchase capacity from a pool, or spend thousands on specialized computer equipment featuring Application Specific Integrated Circuits (ASIC). If we as individuals can not join the block chain and be part of the open ledger verification, can we still call bitcoin a P2P decentralized currency?

A decentralized system needs to have low barriers. It should be easy to take part and even small players should see some level of reward for their contribution. If everyday people can't be part of it using their standard hardware, then the everyday people are not in control of the system.

Ironically the growing difficulty has made mining bitcoins riskier. If you buy specialized hardware, there is no guarantee that you will discover any bitcoin, and as the difficulty continues to increase, your equipment will rapidly be obsolete

If you choose to purchase capacity from a mining pool, then bare in mind that the company you are buying space from is in business to make a profit. They will charge upfront and ongoing fees, which will dilute any returns. On top of this, you are not in control of the rewards, so if the pool is rewarded, there is no guarantee that you will get your fair share.

We have no doubt that home computers will continue to evolve and one day we will reach the point where home computers can once again be used for mining bitcoin. Until that day, we are not comfortable calling bitcoin a decentralized currency